About me

UPTOWN Real Estate Group is your luxury international real estate firm. Our team has more than 30 years of prestige and experience. Hablamos español. Houston & Mexico.

Google+

Popular Posts

Labels

- 2015

- activities

- advertising

- advice

- affordability

- agent

- Agents

- Arabella

- archirectural digest

- architecture

- article

- Available

- baby room

- Baker

- banking

- bathroom

- BERKSHIRE

- Best City in America

- Best Realtors

- best wishes

- Blog

- Braesheights

- buy a new home

- Buying

- caitlyn jenner

- california

- CANACINTRA

- cars

- china

- christmas

- christmas card

- Cities

- coffetable

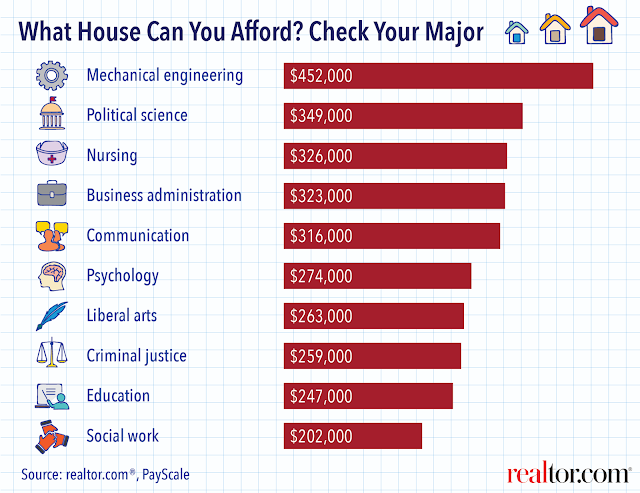

- college major

- color trends

- Communities

- concierge services

- Condo

- crude

- curtains

- customer

- december

- decor

- decoration

- design

- diy

- economy

- employment

- Energy

- EVENT

- experience

- fall

- fashion

- fireplace

- first home buyer

- football

- Galleria

- game

- garage

- garden

- GATEWAY

- gray

- gray interiors

- greater Houston partnership

- grey

- HIGH RISE

- High Rises

- HIGH SOCIETY

- holidays

- Home

- Home Office

- home values

- homeplus

- homes

- hosting

- hot hues

- hottest colors

- house

- house.

- housing

- housing expectations

- Houston

- Hughes Landing

- Ideas

- income

- indicators

- inflation

- infographic

- interior design

- Investments

- jenner

- july

- kitchens

- landscaping

- laundryroom

- lenders

- lendingtree

- lifestyle

- Listings

- livingroom

- loans

- Lori Margolis

- LUCHO

- Luxury

- luxury homes

- Luxury Living

- luxury travel

- makeover

- malibu

- Man Cave

- manners

- MARIANA SALDAÑA

- market

- marketing

- Master Plan

- Media Room

- modern

- mortgage

- move

- Movies

- moving

- national association of realtors

- new construction

- new home

- new homes

- nfl

- november

- nursery

- Office

- oil

- online marketing

- Open House

- Paint Quality Institute

- painting

- PARTY

- party planning

- Patio

- pattern

- payscale

- PELICAN BUILDERS

- penthouse

- people

- perfect house

- Photography

- Place to Live

- plates

- pool

- porch

- rating

- Real Estate

- Real Estate Photography

- Realtor

- relocating

- relocation

- rent

- River Oaks

- rooms

- salary

- sale

- seasons

- Selling

- stadium

- Staging

- statistics

- style

- summer

- sunday

- super

- superbowl

- table setting

- Team

- tello team

- Texas

- thanksgiving

- The Woodlands

- things to do

- Tips

- Top Producers

- Top Properties

- tourist

- travel

- trees

- trends

- Treviso

- triumph lending

- United States

- Uptown

- Uptown Group

- uptowngroup

- usa

- visit

- VOGUE

- waterway

- WILSHIRE

- windows

- Woodlands